Close right-side column

Select a Category

Your Life/Manage/FAQ

External Transfer FAQ

Frequent Questions - External Transfers

1. How do I add an external account?

To add an external account in Online or Mobile Banking by logging into your desired device.

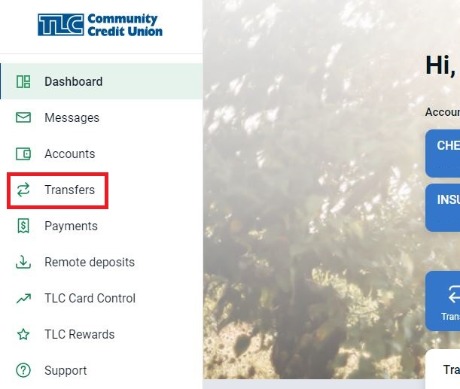

From the Menu, select "Transfer."

Online Banking:

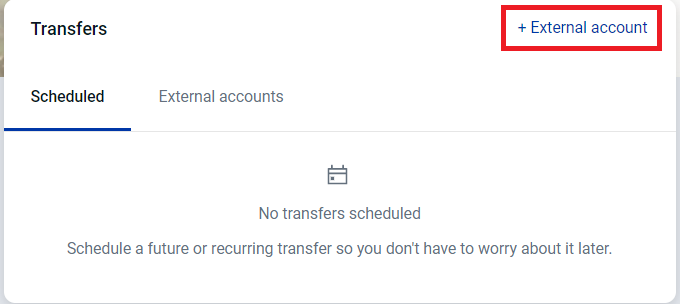

In Online Banking you will click on "+External account."

Mobile Banking:

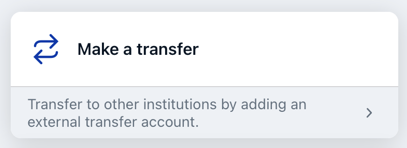

In Mobile Banking you will tap "Transfer to other institutions by adding an external transfer account."

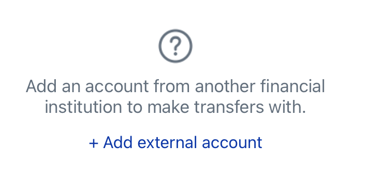

Then tap "+Add external account." You will be asked to enter your full online banking password since you are making a change.

Online & Mobile Banking:

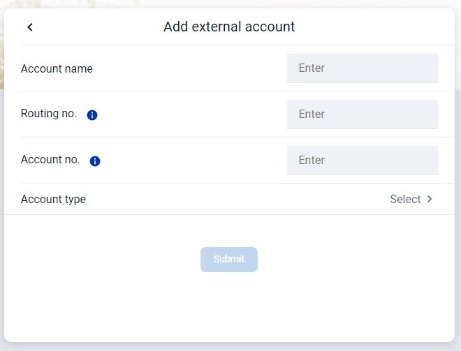

You will enter the information about the external account. You will need the following information for the external account: Routing number, your account number with them, and the type of account you are adding (savings or checking).

The account name is how you would like this account titled in your TLC Online or Mobile Banking. It can be whatever you would like it to be.

Review all the information for your external account. When all of the required fields are completed the "Submit" button will turn dark blue and become clickable. Click "Submit" to finalize your transfer.

Once submitted, TLC will send two small deposits to the other external account. This is called an external account verification (see question 2 for more information).

2. What's an external account verification? How does it work?

As security enhancements continue to be an ongoing focus and priority for TLCCU, we require verification procedures for Online and Mobile Banking external transfer account setups. (Formally called Financial to Financial Transfers)

When a new financial institution is set up, our system will generate two deposits for random amounts less than $1.00 at your other Financial Institution.

After you receive the deposits, you must verify these transaction amounts in Online or Mobile Banking before scheduling any transfers. This ensures that the correct information about the external account was correctly entered, and that your transfers to or from that institution with TLC will be successful.

3. Can I opt out of external account verification process?

No, for security purposes this will be required for all new account setups.

4. How do I verify an external account?

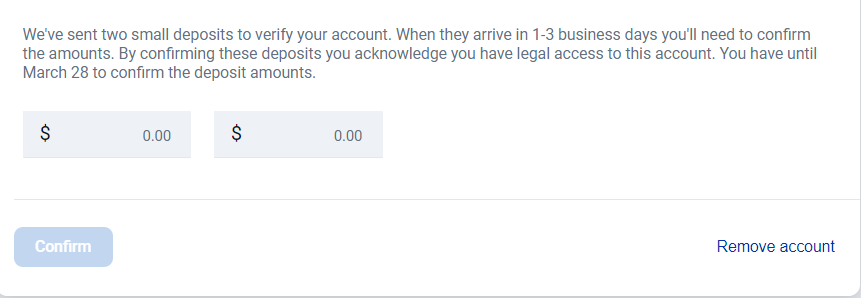

Online Banking - verify external account:

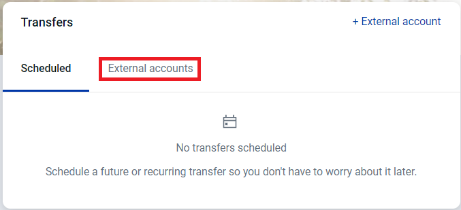

Click "Transfers" from the sidebar Menu.

Click on the "External accounts" tab.

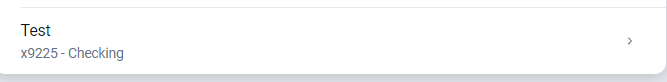

Click on the external account you are verifying.

Enter the two deposit amounts you received at your other institution and click "Confirm."

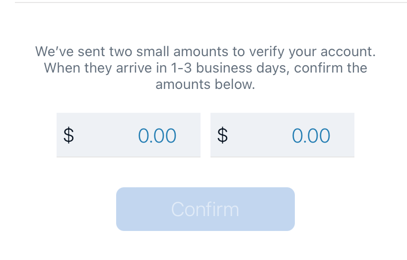

Mobile Banking - verify external account:

Tap the Menu Icon  (three lines) in the top left corner. Then tap on "Transfers" from the sidebar menu.

(three lines) in the top left corner. Then tap on "Transfers" from the sidebar menu.

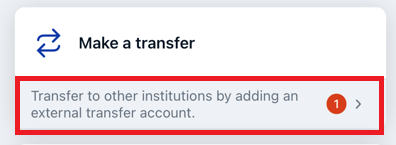

Click on "Transfer to other institutions by adding an external transfer account". There will be a notification to catch your attention that something needs done.

Enter the two deposit amounts you received at your other institution and tap "Confirm."

5. How long do I have to provide the verification amount?

The new external account will be removed from Online/Mobile Banking after 39 days of when the setup was first established if you do not provide the verification amounts.

6. How many attempts do I have to provide the amount?

You will have 3 attempts to correctly enter the verification transaction amount. If this is exceeded, the financial institution will be locked from use and the set up will need to be added again.

7. How do I make an external account transfer?

Once the external account verification process has been completed, the external account will be active and you can begin scheduling transfers. With external account transfers you can schedule transfers TO your TLC accounts, credit cards, or loans from an external account. You can also schedule transfers FROM your TLC account to that external account. The steps are almost identical.

From your dashboard click on "Transfer" icon.

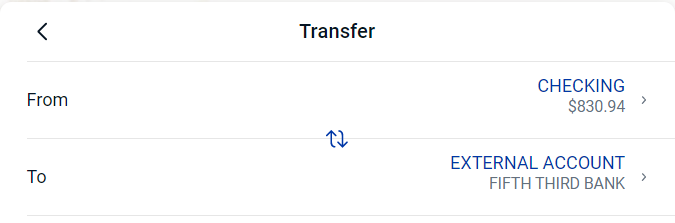

Transfer from TLC to External Account:

To transfer FROM your TLC account TO your external account, select which TLC share you would like the funds to transfer FROM and select your external account as the TO option.

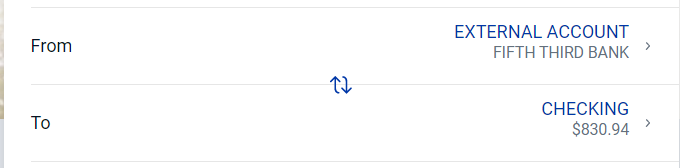

Transfer from External Account to TLC:

To transfer FROM your external account TO your TLC account/loan/credit card*, select your external account as the TO option and then select which TLC account/loan/credit card* as the FROM option.

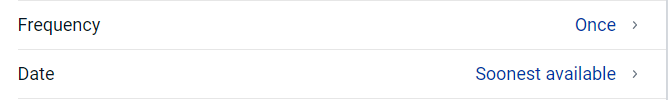

Click on "More options" if you would like to make an external transfer recurring by changing the frequency or schedule a future transfer by changing the date.

*Transfer payments from external accounts to your TLC credit card cannot exceed the current balance on your card. If this occurs, the transfer will be rejected by our system, the funds sent back to your external account, and your payment will not be completed.

8. When will my external transfers be sent?

External transfers are processed each day at 6:00 PM, Sunday - Thursday. Once the verification process is complete, you can expect the transfer to be completed in approximately 1-3 business day.

Don't see your question?

We'd love to hear from you!

Zelle® and the Zelle® marks are property of Early Warning Services, LLC and are used herein under license.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Google and Google Play and the logos are a trademark of Google Inc.